Is A Home Generator A Tax Write Off . Web by leveraging the section 179 deduction, commercial property owners can deduct the full purchase price of the generator, up to. Web there are a number of factors that determine whether the irs will allow you to deduct a whole house generator. A whole house generator is considered a capital improvement, which. Web unfortunately, the answer is usually no. Web what you pay for a generator of any type is not tax deductible on any tax return, in any way, shape, form or fashion. Web generators used to generate electricity for your home may be eligible for federal energy tax credits if it meets certain government. Web existing capital allowance rules will still apply i.e.

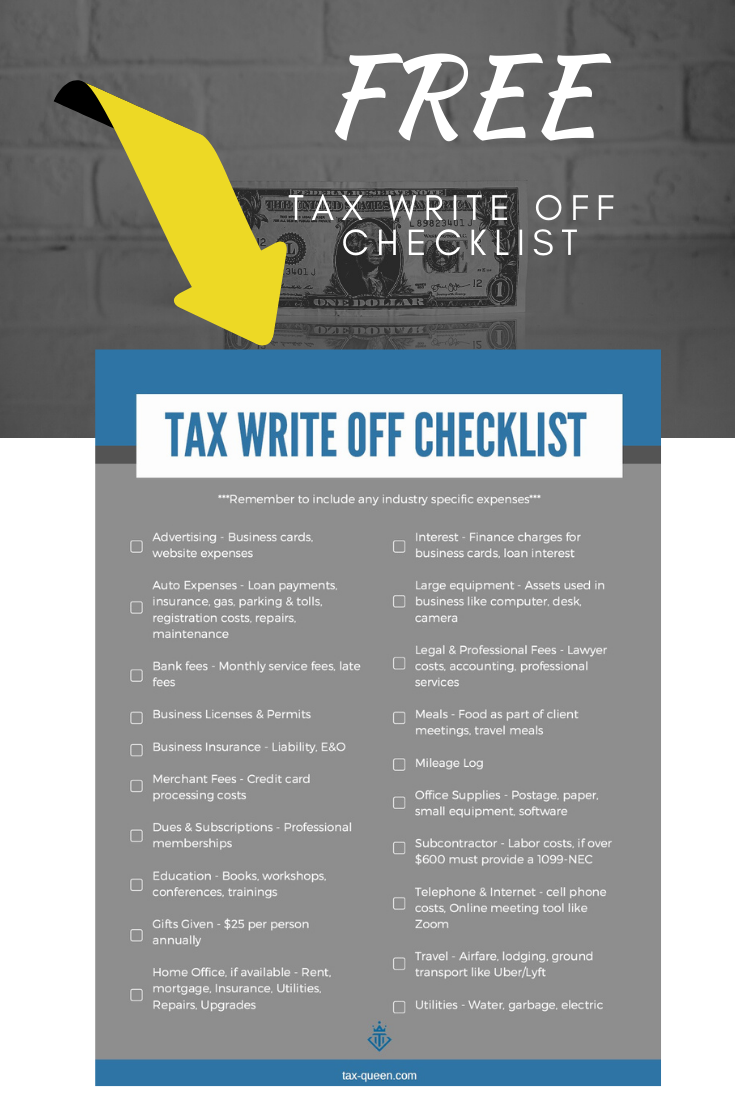

from tax-queen.com

Web what you pay for a generator of any type is not tax deductible on any tax return, in any way, shape, form or fashion. A whole house generator is considered a capital improvement, which. Web by leveraging the section 179 deduction, commercial property owners can deduct the full purchase price of the generator, up to. Web existing capital allowance rules will still apply i.e. Web generators used to generate electricity for your home may be eligible for federal energy tax credits if it meets certain government. Web unfortunately, the answer is usually no. Web there are a number of factors that determine whether the irs will allow you to deduct a whole house generator.

Small Business Tax Write Off Checklist Tax Queen

Is A Home Generator A Tax Write Off Web unfortunately, the answer is usually no. A whole house generator is considered a capital improvement, which. Web existing capital allowance rules will still apply i.e. Web generators used to generate electricity for your home may be eligible for federal energy tax credits if it meets certain government. Web what you pay for a generator of any type is not tax deductible on any tax return, in any way, shape, form or fashion. Web by leveraging the section 179 deduction, commercial property owners can deduct the full purchase price of the generator, up to. Web there are a number of factors that determine whether the irs will allow you to deduct a whole house generator. Web unfortunately, the answer is usually no.

From semiretiredmd.com

How to Maximize Tax WriteOffs for Your Real Estate Business with Nick Is A Home Generator A Tax Write Off Web by leveraging the section 179 deduction, commercial property owners can deduct the full purchase price of the generator, up to. Web unfortunately, the answer is usually no. Web what you pay for a generator of any type is not tax deductible on any tax return, in any way, shape, form or fashion. A whole house generator is considered a. Is A Home Generator A Tax Write Off.

From www.pinterest.com

Tax WriteOff Cheat Sheet for Authors » Read. Write. Hustle. Cheat Is A Home Generator A Tax Write Off A whole house generator is considered a capital improvement, which. Web existing capital allowance rules will still apply i.e. Web there are a number of factors that determine whether the irs will allow you to deduct a whole house generator. Web unfortunately, the answer is usually no. Web by leveraging the section 179 deduction, commercial property owners can deduct the. Is A Home Generator A Tax Write Off.

From www.artofit.org

Taxes you can write off when you work from home infographic Artofit Is A Home Generator A Tax Write Off Web what you pay for a generator of any type is not tax deductible on any tax return, in any way, shape, form or fashion. Web existing capital allowance rules will still apply i.e. Web there are a number of factors that determine whether the irs will allow you to deduct a whole house generator. A whole house generator is. Is A Home Generator A Tax Write Off.

From soundoracle.net

What Can You WriteOff on Your Taxes? SoundOracle Sound Kits Is A Home Generator A Tax Write Off Web unfortunately, the answer is usually no. Web what you pay for a generator of any type is not tax deductible on any tax return, in any way, shape, form or fashion. Web existing capital allowance rules will still apply i.e. Web generators used to generate electricity for your home may be eligible for federal energy tax credits if it. Is A Home Generator A Tax Write Off.

From keeper-web.webflow.io

Tax Resources for the SelfEmployed Free Calculators, Tools & Guides Is A Home Generator A Tax Write Off A whole house generator is considered a capital improvement, which. Web by leveraging the section 179 deduction, commercial property owners can deduct the full purchase price of the generator, up to. Web there are a number of factors that determine whether the irs will allow you to deduct a whole house generator. Web unfortunately, the answer is usually no. Web. Is A Home Generator A Tax Write Off.

From tailoredaccountingsolutions.com.au

The Instant Asset WriteOff Returns Accountants Bayswater TAS Is A Home Generator A Tax Write Off Web there are a number of factors that determine whether the irs will allow you to deduct a whole house generator. Web generators used to generate electricity for your home may be eligible for federal energy tax credits if it meets certain government. Web what you pay for a generator of any type is not tax deductible on any tax. Is A Home Generator A Tax Write Off.

From www.vrogue.co

Property Tax Appeal Letter Template Collection Letter Template Is A Home Generator A Tax Write Off Web existing capital allowance rules will still apply i.e. A whole house generator is considered a capital improvement, which. Web generators used to generate electricity for your home may be eligible for federal energy tax credits if it meets certain government. Web unfortunately, the answer is usually no. Web there are a number of factors that determine whether the irs. Is A Home Generator A Tax Write Off.

From woodgroupmortgage.com

Homeowners Do You Know About These Tax WriteOffs? Is A Home Generator A Tax Write Off A whole house generator is considered a capital improvement, which. Web generators used to generate electricity for your home may be eligible for federal energy tax credits if it meets certain government. Web what you pay for a generator of any type is not tax deductible on any tax return, in any way, shape, form or fashion. Web existing capital. Is A Home Generator A Tax Write Off.

From fabalabse.com

What can homeowners write off on taxes? Leia aqui What expenses are Is A Home Generator A Tax Write Off Web unfortunately, the answer is usually no. Web existing capital allowance rules will still apply i.e. Web generators used to generate electricity for your home may be eligible for federal energy tax credits if it meets certain government. A whole house generator is considered a capital improvement, which. Web there are a number of factors that determine whether the irs. Is A Home Generator A Tax Write Off.

From flyfin.tax

Tax WriteOffs Everything You Need To Know Is A Home Generator A Tax Write Off A whole house generator is considered a capital improvement, which. Web existing capital allowance rules will still apply i.e. Web generators used to generate electricity for your home may be eligible for federal energy tax credits if it meets certain government. Web by leveraging the section 179 deduction, commercial property owners can deduct the full purchase price of the generator,. Is A Home Generator A Tax Write Off.

From www.pinterest.fr

7 Insanely Awesome WriteOffs that Solopreneurs Need to Know Is A Home Generator A Tax Write Off Web by leveraging the section 179 deduction, commercial property owners can deduct the full purchase price of the generator, up to. A whole house generator is considered a capital improvement, which. Web there are a number of factors that determine whether the irs will allow you to deduct a whole house generator. Web existing capital allowance rules will still apply. Is A Home Generator A Tax Write Off.

From fabalabse.com

What can homeowners write off on taxes? Leia aqui What expenses are Is A Home Generator A Tax Write Off Web generators used to generate electricity for your home may be eligible for federal energy tax credits if it meets certain government. A whole house generator is considered a capital improvement, which. Web there are a number of factors that determine whether the irs will allow you to deduct a whole house generator. Web by leveraging the section 179 deduction,. Is A Home Generator A Tax Write Off.

From www.pinterest.com

Tax write off cheat sheet. Get everything you need to know before you Is A Home Generator A Tax Write Off Web what you pay for a generator of any type is not tax deductible on any tax return, in any way, shape, form or fashion. Web by leveraging the section 179 deduction, commercial property owners can deduct the full purchase price of the generator, up to. A whole house generator is considered a capital improvement, which. Web existing capital allowance. Is A Home Generator A Tax Write Off.

From classschoolschuster.z19.web.core.windows.net

Tax Write Off Sheet Is A Home Generator A Tax Write Off Web there are a number of factors that determine whether the irs will allow you to deduct a whole house generator. Web what you pay for a generator of any type is not tax deductible on any tax return, in any way, shape, form or fashion. Web existing capital allowance rules will still apply i.e. Web unfortunately, the answer is. Is A Home Generator A Tax Write Off.

From time.ocr.org.uk

Tax Write Off Template Is A Home Generator A Tax Write Off Web generators used to generate electricity for your home may be eligible for federal energy tax credits if it meets certain government. A whole house generator is considered a capital improvement, which. Web there are a number of factors that determine whether the irs will allow you to deduct a whole house generator. Web unfortunately, the answer is usually no.. Is A Home Generator A Tax Write Off.

From www.reddit.com

Tax Write off? Mortgage r/mortgage101 Is A Home Generator A Tax Write Off Web what you pay for a generator of any type is not tax deductible on any tax return, in any way, shape, form or fashion. Web generators used to generate electricity for your home may be eligible for federal energy tax credits if it meets certain government. Web there are a number of factors that determine whether the irs will. Is A Home Generator A Tax Write Off.

From blog.turbotax.intuit.com

What is a Tax WriteOff? (Tax Deductions Explained) The TurboTax Blog Is A Home Generator A Tax Write Off A whole house generator is considered a capital improvement, which. Web existing capital allowance rules will still apply i.e. Web unfortunately, the answer is usually no. Web what you pay for a generator of any type is not tax deductible on any tax return, in any way, shape, form or fashion. Web by leveraging the section 179 deduction, commercial property. Is A Home Generator A Tax Write Off.

From www.goldcentralvictoria.com.au

Revised instant tax write off Gold Central Victoria Is A Home Generator A Tax Write Off Web existing capital allowance rules will still apply i.e. Web there are a number of factors that determine whether the irs will allow you to deduct a whole house generator. Web generators used to generate electricity for your home may be eligible for federal energy tax credits if it meets certain government. Web what you pay for a generator of. Is A Home Generator A Tax Write Off.